Banking from your phone?

Download our app

Welcome Back

You can access your accounts here.

Banking from your phone?

Scan the code to download our app.

featured

2024-03-27

Financial Health

published

Your Guide to All Things Credit

-

Understanding the ins and outs of credit can be overwhelming, especially because there are countless terms and concepts to grasp. We are here to simplify it for you—all in one place. From credit basics to building your credit score with a secured credit card, this guide covers everything you need to know about credit. We’re breaking down all aspects into clear and accessible information, making it easy for everyone to understand credit. Let’s commence!

Fundamentals of Credit

Credit serves as an important financial tool, and it gives individuals the ability to borrow money with the promise of repayment, typically with interest. It provides a convenient solution for making purchases or accessing services when immediate cash is unavailable.

Credit is obtained directly from sellers or through financial intermediaries like banks. For example, retail sellers may grant something like store credit, whereas banks often grant credit cards or loans. Receiving credit approval from these creditors hinges on one’s financial history and reliability.

A positive track record of responsible financial management results in what is commonly referred to as "good credit."

Credit Limits

A credit limit represents the maximum amount a lender permits an individual to spend using a specific credit card or line of credit. Determined by various factors such as credit score, personal income, and repayment history, credit limits are subject to change by lenders. By keeping up with paying bills on time and not using too much of your available credit, you can help increase your credit limit. This means you'll have more access to credit and feel more secure about your finances.

Credit Report

Your credit report serves as a complete record of your credit history, including details of borrowing and repayment activities. This report is compiled by credit bureaus based on information provided by creditors and other sources. It includes relevant data such as credit accounts, payment history, credit inquiries, and public records like bankruptcies or liens.

Credit Profile

While a credit report offers raw data, a credit profile presents a broader assessment of one's creditworthiness. This incorporates factors beyond credit history, such as credit score, income, employment history, and overall financial situation. Lenders and financial institutions evaluate credit profiles to determine credit risk.

Credit Score

A credit score is a numerical representation of an individual's creditworthiness, gauging their likelihood of repaying borrowed funds. Based on information in credit reports, credit scores typically range between 300 and 850, with higher scores indicating better creditworthiness.

Lenders categorize credit scores into ranges such as excellent, good, fair, and poor. The higher your credit score, the more financial benefits you can access, such as lower interest rates and better loan terms.

- 720 to 850: Excellent Credit

- 690 to 719: Good Credit

- 630 to 689: Fair Credit

- 629 or below: Bad/Poor Credit

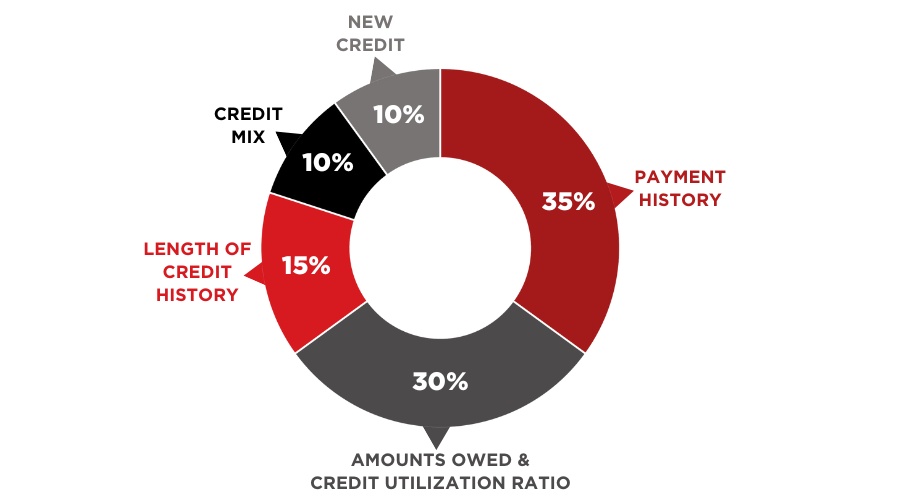

Factors Impacting Credit Scores

Understanding what affects your credit score is crucial for managing your finances effectively. The factors may vary, but the most common ones include:

- Payment History (35%): Your payment history reflects how consistently you make payments on your credit accounts. Making timely payments can positively impact your credit score, while missed payments or defaults can lower it significantly.

- Credit Utilization Ratio (30%): This ratio compares your credit card balances to your credit limits. Maintaining a low ratio, ideally below 30%, is favorable for credit scores. However, an even lower ratio, such as 10%, is even better for maintaining healthy credit.

- Credit History (15%): Your credit history measures how long you have been using credit. Typically, a longer credit history is viewed positively by lenders because it provides a more extensive record of your credit management.

- Credit Mix (10%): Lenders prefer to see a variety of credit accounts on your report, including credit cards, installment loans (like mortgages and auto loans), and retail accounts. Having a diverse mix suggests responsible credit management.

- New Credit (10%): Applying for an excessive amount of new credit poses risks, signaling to lenders potential desperation for cash. Each credit card application triggers a hard inquiry, temporarily lowering your score. To maintain a healthy score, apply thoughtfully, spacing out applications, and only when necessary. Regularly monitor your credit report to address any issues.

By understanding these factors, you can take proactive steps to improve your credit score and financial well-being. For more information about credit scoring, dive deeper into our previous blog.

Credit Building

Credit building is an important part of managing your finances effectively. It helps improve your creditworthiness, making it easier to get better options for loans and credit cards. To build credit successfully, it's important to keep an eye on your credit score, make payments on time, and manage your credit responsibly.

To learn helpful tips and strategies for building credit, check out: Building Credit and How it Works.

Secured Credit Card: The Best Credit Card for Building Credit

Secured credit cards are particularly beneficial for credit building because they offer individuals with limited or poor credit history an opportunity to establish or rebuild their credit. They function similarly to traditional credit cards but require a refundable security deposit, which determines the spending limit and serves as collateral for the card issuer in case the cardholder defaults on payments.

Armed Forces Bank offers the Credit Builder Secured Visa® Credit Card, designed specifically to support individuals in their credit building activities. With customizable credit limits and no application, annual, or over-limit fees, this secured card provides a flexible and cost-effective means of establishing credit history and achieving financial goals.

Plus, as your credit improves over time, you may have the opportunity to upgrade to an unsecured card with additional perks and benefits. Take the first step towards building your credit today by applying for the best credit card for building credit.

Helpful Resources: Credit Assessment Calculator and Credit Card Payoff Calculator.

Member FDIC

Subject to credit approval. Transaction and Penalty fees apply. Credit Builder Savings account required. $5.00 quarterly fee charged to the Credit Builder Savings account if not enrolled in eStatements. Improved credit score is not guaranteed. Credit score is determined by credit reporting agencies based on multiple factors, but satisfactory performance on a credit card product can improve your credit score. Default on a credit card, including missed or late payments can damage your credit score. Once added, funds cannot be withdrawn from the Credit Builder Savings account and the Credit Builder credit card without closing the savings account and the credit card.