Banking from your phone?

Download our app

Welcome Back

You can access your accounts here.

Banking from your phone?

Scan the code to download our app.

featured

2024-03-21

Financial Health

published

Understanding Credit Scoring: What Determines Your Credit Score?

-

Credit scores may seem daunting, but they are actually easier to understand than you might think. So, what exactly are credit scores? Simply put, a credit score is a three-digit number that tells a lender how trustworthy you are. It’s based on your history of borrowing and repaying money. A credit score is a numerical reflection of your financial responsibility, and it can unlock opportunities for better interest rates, easier loan approvals, and even job opportunities.

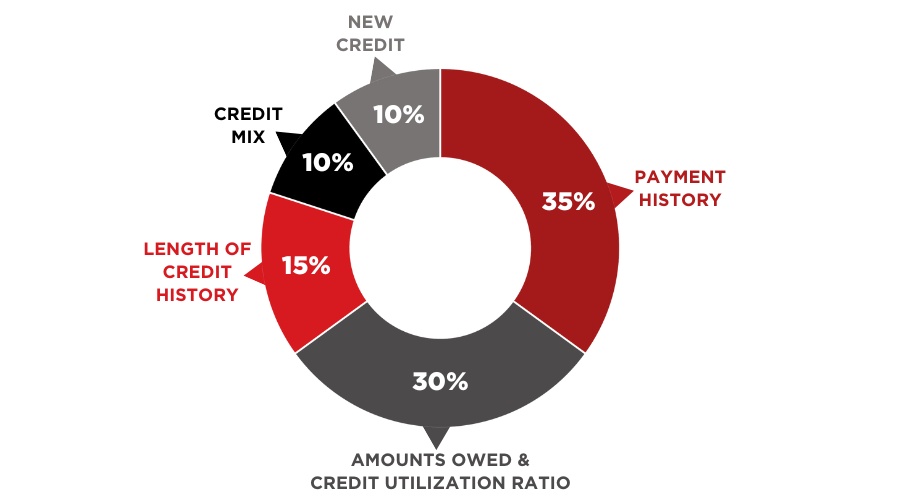

Today, we are taking a look at the world of credit scoring. We will explore the factors shaping your creditworthiness, such as including payment history and credit utilization. And we’ll also discuss tactics to work toward a good credit score, such as utilizing secured credit cards.

Payment History: 35% of Your Credit Score

Your payment history is extremely important when it comes to credit scoring, accounting for 35% of your overall score. The key is to consistently pay your bills on time, which will help you establish a positive payment record. This proves to lenders that you are reliable and capable of managing your credit responsibly.

Amount Owed & Credit Utilization Ratio: 30%

The second most significant factor influencing your credit score involves both the amount you owe and your credit utilization ratio. Credit utilization ratio means the proportion of your available credit currently being used, and it is affected by your financial decisions and plays a pivotal role in assessing your creditworthiness. People with high credit scores typically maintain low utilization ratios, often below 10%. Additionally, the number of accounts open and their management can also affect your score.

Credit History: 15%

Your credit history isn't just about paying your bills on time. It shows how long you've had your lines of credit open. Usually, the longer you've had accounts open, the better your credit score. This indicates you've been responsibly managing your personal loans and other forms of credit over time. Your credit history accounts for about 15% of your credit score.

Credit Mix: 10%

Credit mix is about the variety of credit you've used over time, and it also affects your credit score. Lenders, such as credit card issuers, like to see a mix of different types of credit, like installment loans (such as mortgage loans or student loans) and revolving accounts (such as credit cards). This shows them that you can handle various financial obligations. Having a good mix of credit makes you more attractive to lenders and helps credit scoring systems positively evaluate your creditworthiness. However, your credit mix only constitutes about 10% of your score.

New Credit: 10%

Applying for too much credit at once can be risky – this often tells lenders you might be in urgent need of cash. Also, each time you apply for a credit card, it triggers something called a hard inquiry, which can lower your credit score for a while. To keep your score healthy, be careful about how often you apply for credit, spread out your applications, and only apply for new credit when you really need it. And don't forget to check your credit report regularly to stay on top of things and make sure nothing's hurting your credit score. New credit typically makes up about 10% of your credit score.

How to Get a Better Credit Score

With an improved understanding of credit scoring and how it works, it's time to take action and work towards a higher credit score. One of the most effective strategies is to build credit with a secured credit card.

A secured credit card operates similarly to a traditional credit card but requires a security deposit, which determines your credit limit. This deposit serves as collateral, making secured credit cards accessible for individuals with limited or poor credit history.

At Armed Forces Bank, we're proud to offer the Credit Builder Secured Visa® Credit Card, designed specifically to boost your credit-building journey. With features like automatic reporting to the three major credit bureaus and the flexibility to set your own credit limit (ranging from $300 to $3,000), this secured card empowers you to manage your finances while strengthening your credit profile.

Furthermore, we provide a range of tools and resources to support your credit-building efforts, including credit assessment calculators, credit card payoff calculators, and valuable credit tips and advice. With our guidance and your commitment, you can pave the way to a better financial future. Take the first step today towards stronger credit and greater financial freedom with Armed Forces Bank by your side.

Member FDIC

Subject to credit approval. Transaction and Penalty fees apply. Credit Builder Savings account required. $5.00 quarterly fee charged to the Credit Builder Savings account if not enrolled in eStatements. Improved credit score is not guaranteed. Credit score is determined by credit reporting agencies based on multiple factors, but satisfactory performance on a credit card product can improve your credit score. Default on a credit card, including missed or late payments can damage your credit score. Once added, funds cannot be withdrawn from the Credit Builder Savings account and the Credit Builder credit card without closing the savings account and the credit card.