Banking from your phone?

Download our app

Welcome Back

You can access your accounts here.

Banking from your phone?

Scan the code to download our app.

not featured

2022-11-30

Military Family

published

2022 Military Holiday Spending Survey

-

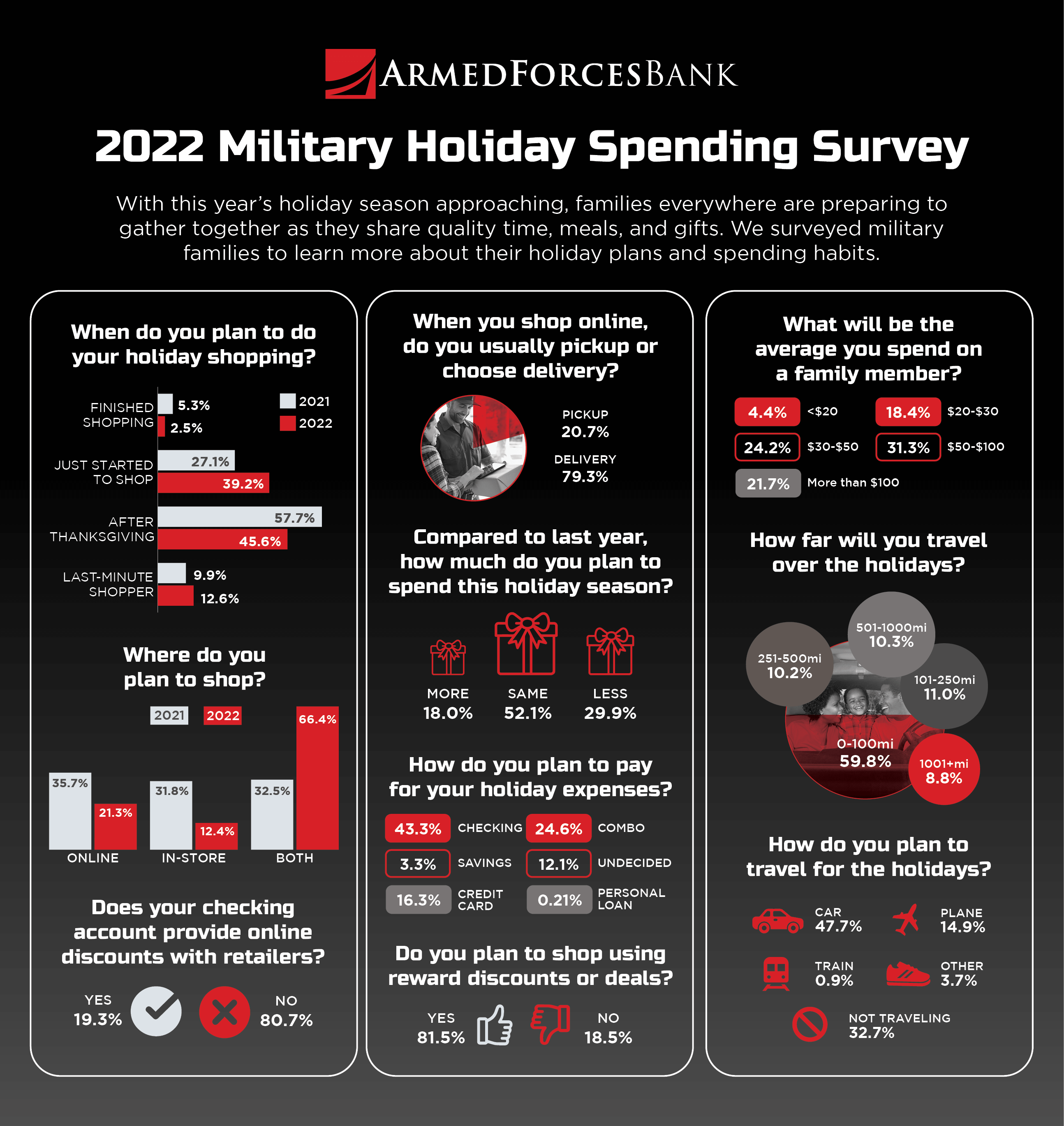

With this year’s holiday season approaching, families everywhere are preparing to gather together as they share quality time, meals, and gifts. For the second year in a row, Armed Forces Bank conducted a survey of military families to find out how they’re approaching holiday shopping this year.

Learn about the results of the survey.

Inflation’s Impact on Holiday Shopping

At this point in the year, almost all of us have felt the impact of inflation -- whether you’re in the U.S. or stationed abroad. Consumer prices have risen substantially in more than 35 countries around the world. Which means that holiday shoppers are likely to feel the pinch on their wallets this year.

For that reason, many financially conscious consumers will be looking for deals and discounts to help them make their holiday dreams come true. And many retailers are slashing prices for the occasion: discounts on computers, toys, TVs, appliances, and furniture/bedding are expected to be at the highest level in three years.

Holiday Survey Results

We asked our survey respondents to share information on their holiday gifting habits and what this year’s shopping will look like. In total, we had 1,434 responses -- which means participation increased more than 400% over last year. We’re excited to share the data from such a significant survey.

1. When do you plan to do your holiday shopping?

Fewer respondents are waiting until after Thanksgiving to start their shopping compared to last year. While last year’s widely publicized supply chain issues meant many were urged to start shopping early, not everyone heeded the advice. With supply chain issues still ongoing, shoppers may have learned an unpleasant lesson last year which has contributed to the change in habit.

Finished shopping already: 2.5%

In 2021: 5.3%

Just started to shop: 39.2%

In 2021: 27.1%

After Thanksgiving: 45.6%

In 2021: 57.7%

Last minute shopper: 12.6%

In 2021: 9.9%

2. Where do you plan to shop?

With the COVID pandemic’s impact becoming less apparent in everyday life, fewer people will be shopping exclusively online compared to last year -- a vast majority of shoppers will shop both online and in-store.

Mostly online: 21.3%

In 2021: 35.7%

Mostly in-store: 12.4%

In 2021: 31.8%

Both: 32.5%

In 2021: 66.4%

3. When you shop online, do you prefer to pick-up in the store or have it delivered?

The convenience of online shopping and delivery is something to which shoppers have become accustomed although some do prefer to pick up their orders in-store.

Pickup: 20.7%

Delivery: 79.3%

4. How much do you plan to spend this holiday season?

Nearly one-third of families are sticking to a lower budget this year when it comes to holiday spending.

Less than last year: 29.9%

The same as last year: 52.1%

More than last year: 18.0%

5. How do you plan on paying for your holiday expenses?

Most families are using a checking account or a combination of methods to pay for their holiday expenses this year. Less than one percent are taking advantage of tools such as personal loans, including our Military Access Loan.*

Checking: 43.3%

Savings: 3.3%

Credit card: 16.3%

Personal loan: 0.21%

A combination of the above: 24.6%

Not decided: 12.1%

6. Do you plan to shop using reward discounts or deals?

A majority of shoppers are planning to use deals and discounts to save money on their holiday expenses. These may be store-wide or site-wide sales, rewards points, or other types of discounts.

Yes: 81.5%

No: 18.5%

7. Does your checking account provide you online discounts to retailers?

While most shoppers want to save money on shopping, less than 20% state that their checking account provides them with online discounts to retailers, like our Access Rewards Checking account.**

Yes: 19.3%

No: 80.7%

8. What will be the average you plan to spend on a family member's gift?

Nearly 80% of gift givers planned to spend an average of $30 or more on a family member’s gift, and 53% planned to spend at least $50.

Under $20: 4.4%

$20 - $30: 18.4%

$30 - $50: 24.2%

$50 - $100: 31.3%

More than $100: 21.7%

9. How far will you be traveling over the holidays?

Most respondents are sticking close to home for the holidays -- nearly 60% said they’ll travel 100 miles or less.

0-100 miles: 59.8%

101-250 miles: 11.0%

251-500 miles: 10.2%

501-1000 miles: 10.3%

1000+ miles: 8.8%

10. How do you plan to travel for the holidays?

With the short travel distance for most respondents, it’s no surprise that cars led the way as the most popular means of travel this year.

Plane: 14.9%

Car: 47.7%

Train: 0.91%

Other: 3.7%

Not traveling 32.7%

A Military Access Loan Can Help with Holiday Shopping

An Access Loan from Armed Forces Bank* can help with your holiday shopping this season. It’s just one of the ways we serve those who serve.

Our Access Loan gives our military community access to the money you need. It can help take the stress off the holiday shopping experience.

And it comes with a fast and easy approval process as an added bonus. This personal military loan has flexible credit options for Armed Forces Bank clients as well as active duty or retired military borrowers -- even if your credit isn’t perfect. We currently offer Access Loans ranging from $750 to $15,000.

How Does the Access Loan Work?

- Apply online in just minutes

- See instant-approval status

- Receive and accept the loan offer

- Get quick access to the money in an Armed Forces Bank account

If you are already an Armed Forces Bank client, your loan will be deposited directly to your account. If you are new to Armed Forces Bank, a new Access Digital Checking account will be set up first. Your loan proceeds will be deposited there within minutes.

Armed Forces Bank Access Loans offer expanded credit options for existing Armed Forces Bank clients; credit options for borrowers with little or no credit history; fixed terms and monthly payments to simplify your budget; and automated payments so you'll never miss one.

Member FDIC

*Subject to credit approval.

*Origination fees apply.

**Registration/activation required.